Disclaimer: What I am about to show you in this post is a simplified version of the overall event architecture at an asset management firm.

As you may know already, an asset management firm is responsible for managing their clients’ capital. These clients are generally high net-worth individuals, pension funds, corporations, and/or sovereign funds. These clients entrust asset management firms to provide risk-adjusted returns.

Asset management firms vary in size based on their assets under management (AUM). Generally, the higher the AUM, the bigger the size (in terms of employees) of the firm. The sophistication of the technology stack is also related to the size of the firm. A firm with $2 billion AUM will have a much simpler tech stack than a firm with $50 billion AUM.

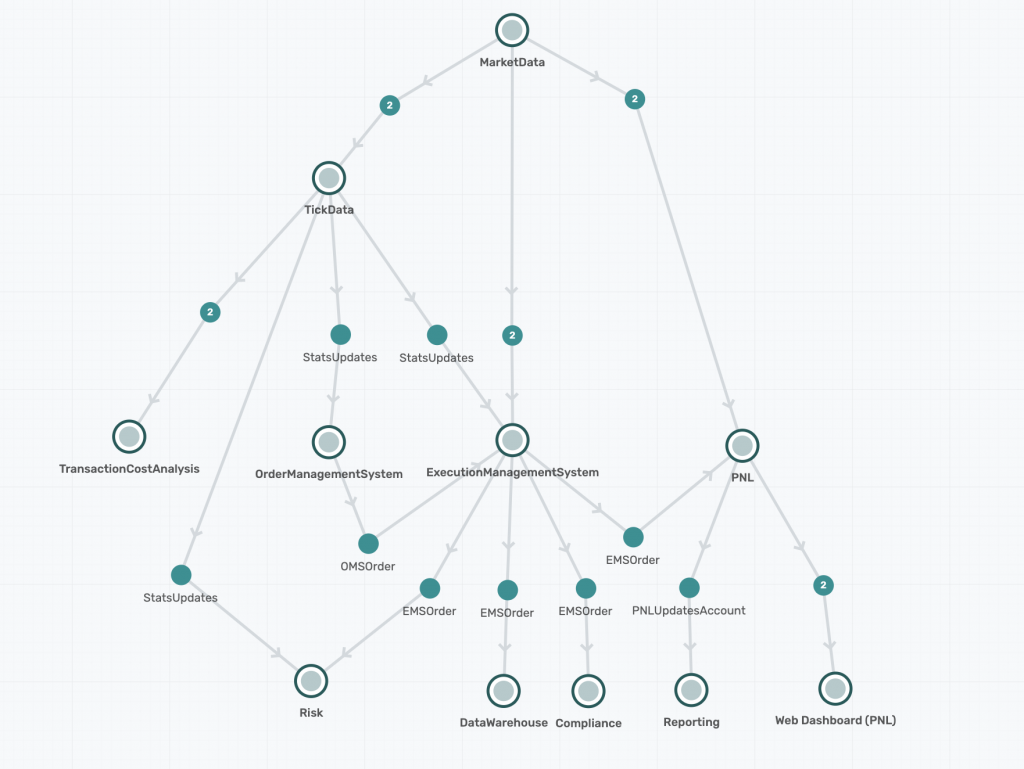

In today’s post, I would like to show a sample flow architecture of a mid-size asset management firm. To do so, I have used Solace’s Event Portal to design my flow architecture.

Typically, you would use Event Portal to design the flow and then implement it using Solace’s PubSub+ broker or another broker of your choice.

Given my background in market/tick-data domain, I have focused more on the flow of pricing data and different events associated with the systems that interact with this data, directly or indirectly. An asset management firm has several other applications, such as Reference Data, that have not been shown in this flow architecture. However, from a high-level, this architecture gives an overview of what the trading architecture might look like at an asset management firm.

Let’s break down each of these applications and what events they publish or subscribe to.

Note: I didn’t include Reference Data because there is very little real-time component to it as it mostly deals with end-of-day batch files. The events it might deal with are mostly going to be notifications about vendor or database statuses.

Market Data

At the top, we have the Market Data application which is responsible for connecting to market data providers and distributing that data to internal clients. This data can be via a real-time feed or end-of-day batch files. To avoid dependency on a particular feed, an asset management firm might want to source data from multiple feeds. For example, if there is an outage with Reuters feed, you can quickly failover to Bloomberg feed and vice-versa.

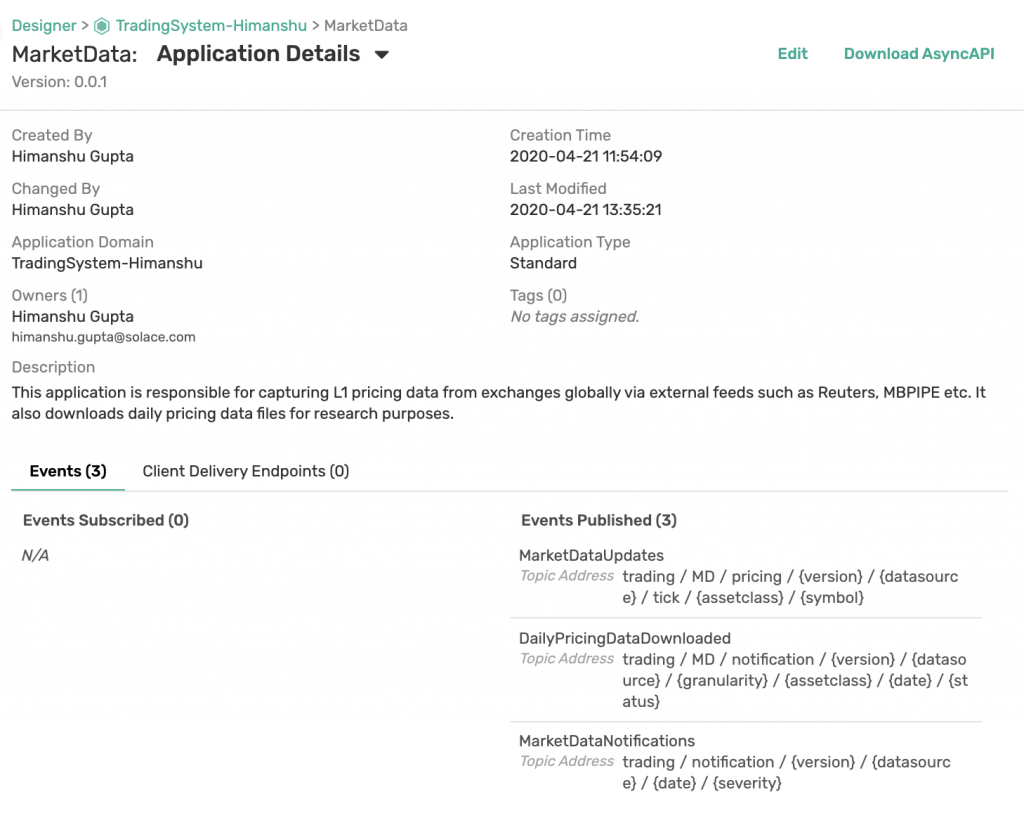

You can click on the application in Event Portal and see more details about the event such as a brief description, application owner, tags, and the events being published and subscribed to by this application.

The MarketData application is not subscribing to any events (since the market data providers are external and out-of-scope). It does, however, publish 3 events: MarketDataUpdates, DailyPricingDataDownloaded, and MarketDataNotifications. And we can see from the screenshot, the topics that these events are published to as well. For example, MarketDataUpdates event is published on trading/MD/pricing/{version}/{datasource}/tick/{assetclass}/{symbol}

So what do these events do? MarketDataUpdates event is fired off whenever there are real-time tick updates. For example, when the stock market opens and securities start trading, their price updates are published as events in real-time. A sample topic AAPL’s price updates might publish on would look like this: trading/MD/pricing/v1/RT/tick/EQ/AAPL. In this topic, MD stands for Market Data, RT stands for Reuters, and EQ stands for equities.

Of course, real-time feeds have outages whether caused by an issue at vendor or exchanges which need to be communicated to downstream users. These notifications can be published via MarketDataNotifications on trading/notification/{version}/{datasource}/{date}/{severity}. For example, users can be notified of a Bloomberg feed outage via an event published on topic: trading/notification/v1/BBG/20210623/CRITICAL.

What about historical data? If a firm is not using event-driven architecture, typically, its workflow would look something like this when it comes to sourcing historical data daily. A vendor will give you an idea of when you can expect batch files to be dropped on some FTP server (let’s say around 1am for previous day’s data). Of course, the files won’t necessarily be ready at 1am but you can start checking after 1am to see if the files are available for you to start processing. So, you build a process on your end to keep polling for updates. Is it there yet? Is it there yet? Once the files are available, you download them locally, process them, and load them into a tick database. While this is happening, your downstream consumers are polling to see if the data has been loaded. Is it loaded yet? Is it loaded yet? And so on…

However, if the firm and the vendor were using event-driven architecture. The vendor will send an event to all its consumers when files are available which will trigger firm’s download process and then it would send an event such as DailyPricingDataDownloaded and let the TickData team know that the files are available to be loaded into the tick database.

Tick Data

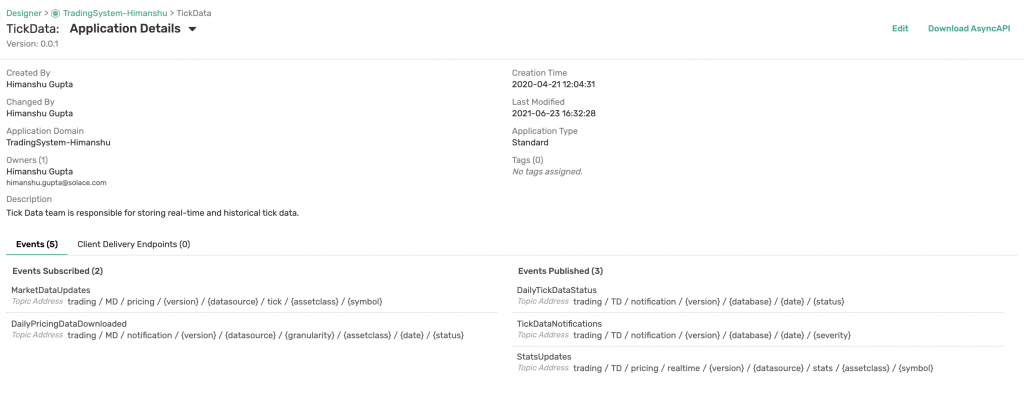

Next, we move on to the team responsible for capturing this real-time and historical data and loading it into a tick database such as kdb+ or OneTick. Solace’s PubSub+ broker has connectors (kdb+, OneTick) to both of these timeseries databases.

The TickData application is both publishing and subscribing to events. It’s subscribing to MarketDataUpdates events to capture all the real-time data from different feeds and it is subscribing to the DailyPricingDataDownloaded notification so it knows when to trigger processes to load historical data.

Additionally, it is publishing three events: DailyTickDataStatus, TickDataNotifications, and StatsUpdates.

DailyTickDataStatus is for publishing events related to the status of TickData’s databases. When data is loaded into a database, an event is published letting downstream consumers of that database know that the data is ready for them to consume. If something goes wrong due to an outage or delay, updates are shared via TickDataNotifications event.

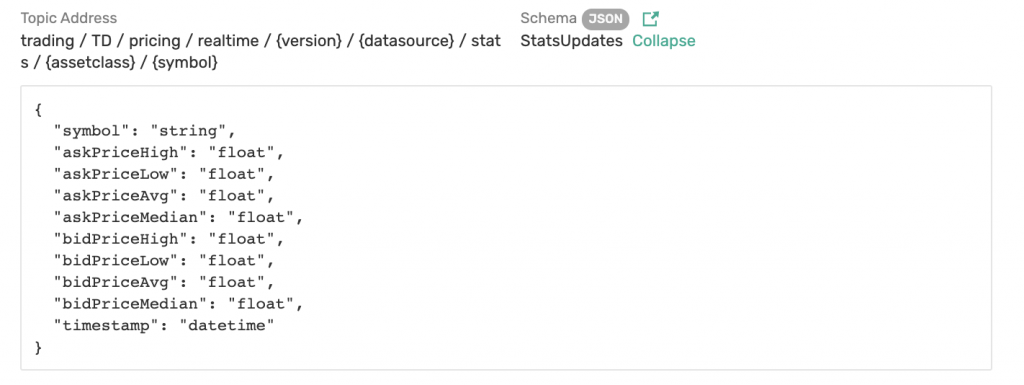

Moreover, TickData application not only captures real-time tick data, but it also computes minutely stats in real-time. For example, not all downstream consumers are interested in tick level granularity. Instead, they prefer stats such as askPriceHigh, askPriceLow, bidPriceHigh, bidPriceLow, vwap etc aggregated per minute (or whatever time interval that suits their usecase). These updates are published on StatsUpdates event.

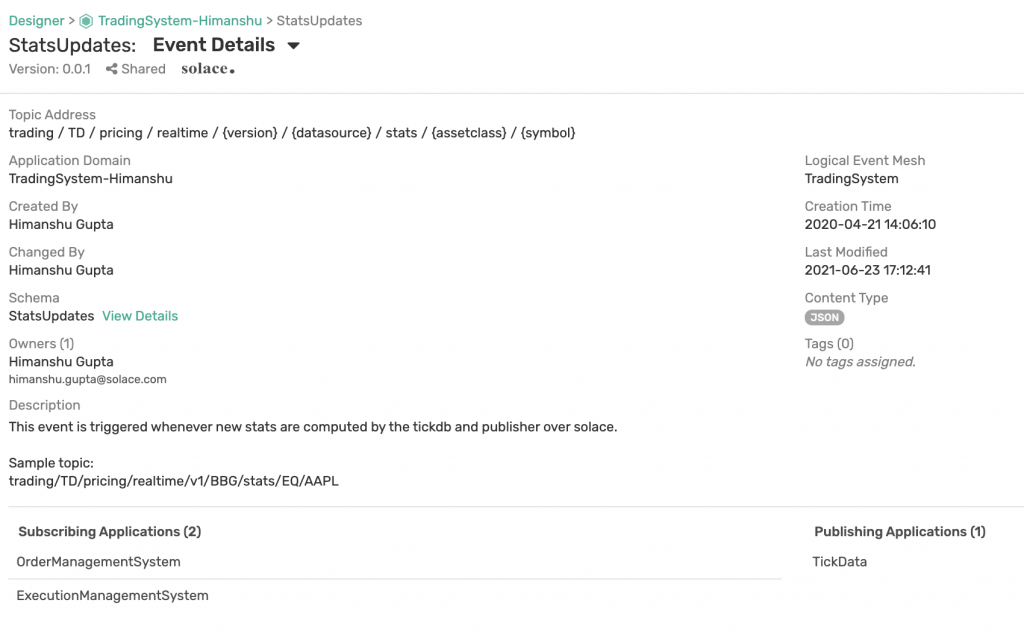

Here is a summary of the StatsUpdates event which tells you which topic it is being published on, event’s owner, brief description, and which applications are publishing and subscribing to this event. As we can see, this event is published only by TickData application but it is subscribed to by OrderManagementSystem (OMS) and ExecutionManagementSystem (EMS) applications. This information is very valuable because it informs us which applications will need to be notified if and when this event gets modified in future.

For each event, you can also see its payload’s schema:

This event has a simple JSON schema but other schema types such as Avro, XML, and Binary are supported as well.

Order and Execution Management Systems

As the name suggests, these two systems are responsible for managing the trade orders and their execution. Many systems combine the two functionalities instead of having separate systems but in this example, I have shown them as separate.

At a buy-side firm, Order Management Systems (OMS) are generally used by portfolio managers (PMs) to get an overview of the portfolios they manage and to make modifications to these portfolios without worrying about the actual execution(s). For example, a PM might want to reduce exposure to a certain security, i.e. IBM, in their portfolio. They can make that change via an OMS but that change will eventually result in orders being placed via an Execution Management System (EMS).

An EMS is responsible for providing connectivity to different exchanges and trading venues. It is used by traders to execute trades as efficiently as possible with the goal of getting the best execution price.

Going back to our flow architecture, we can see that both OMS and EMS applications subscribe to statsUpdates events. OMS is fine with minute level stats but EMS requires more granular data to be able to execute order as efficiently as possible. Hence, it also subscribes to marketDataUpdates, and MarketDataNotifications.

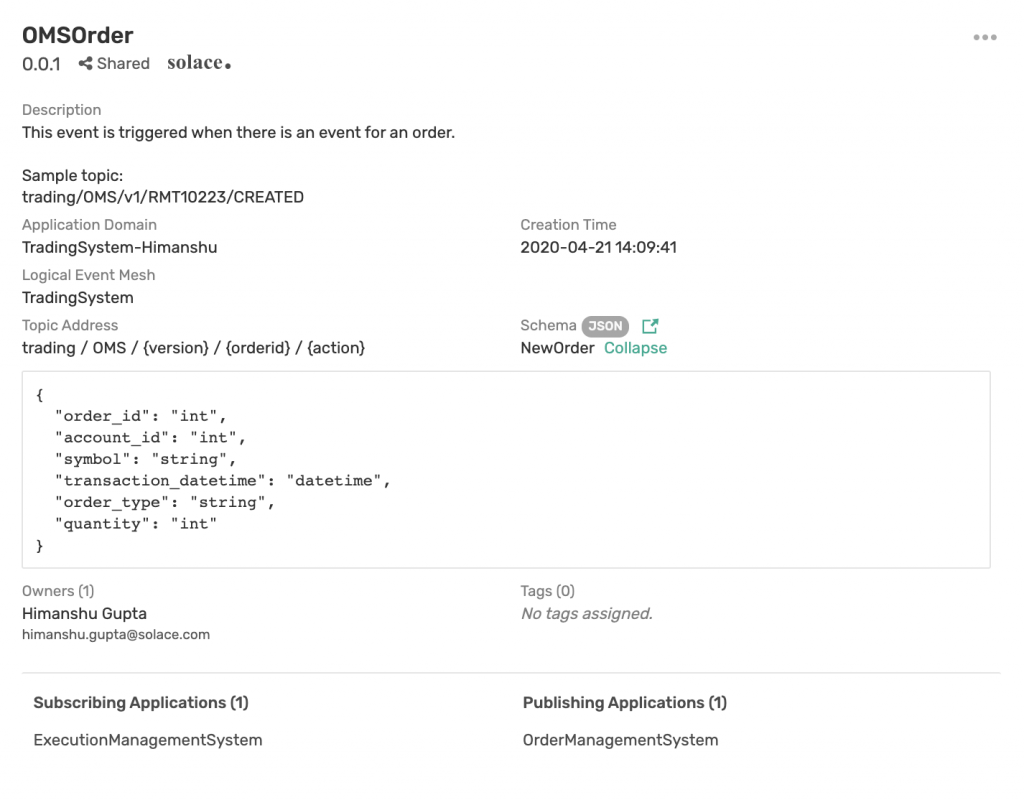

The information about which orders need to be executed is published by OMS via the event OMSOrder and subscribed to by the EMS application. Here is more information about the OMSOrder event:

The event is being published on topic: trading/OMS/{version}/{orderid}/{action}

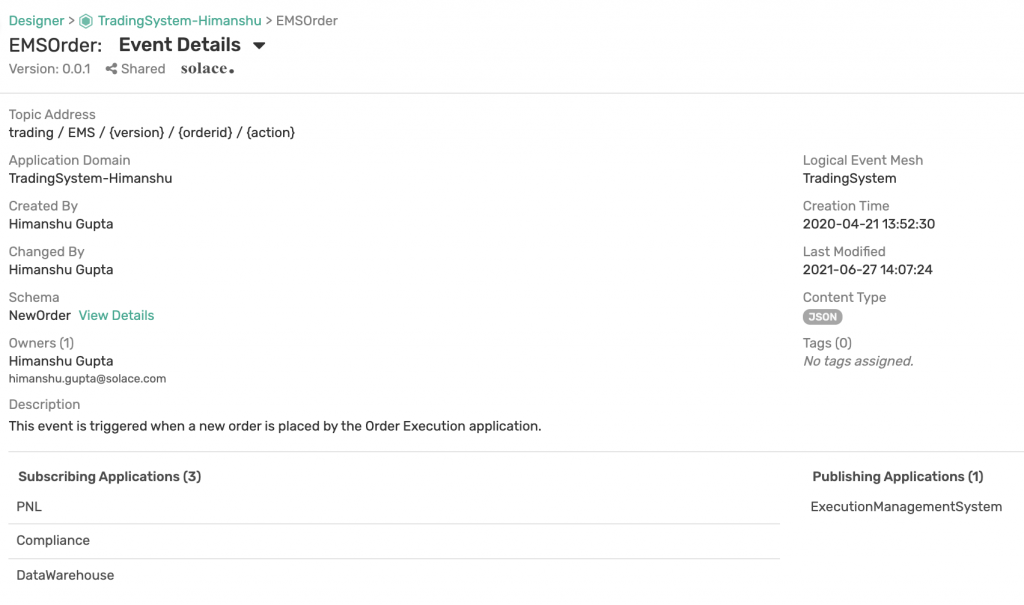

The EMS application publishes EMSOrder event (topic: trading/EMS/{version}/{orderid}/{action}) when it executes an order. This event is subscribed to by the PNL, Compliance, and DataWarehouse applications.

Transaction Cost Analysis (TCA)

Some asset management firms perform their own analysis on their transactions to analyze whether they are executing their orders as efficiently as they would like. Others offload that responsibility of order execution to a third-party which is then responsible for providing regular TCA reports to the asset management firm.

In our example, the firm is performing some or all transactions themselves and hence, is interested in performing its own transaction cost analysis. Such an analysis happens on the previous day’s (as opposed to current day) trading data. Hence, the TCA application is only interested in getting notification data from TickData application instead of real-time updates. The TCA team subscribes to DailyTickDataStatus and TickDataNotifications events to keep track of any outages or issues with databases. Additionally, the TCA application requires trading data which it can directly query from the Data Warehouse application. Since it is not data that is shared in real-time via events, it has not been shown in our flow architecture.

PNL / P&L

Moving on, we have our PNL application which is responsible for showing existing positions and the associated P&L (profit & loss) so the firm and all the investors can get a snapshot of how their investments have been performing. Different stakeholders require different levels of P&L reports. Large investors like pension funds may only require monthly or quarterly reports whereas the asset management firm’s CEO and portfolio managers might require real-time (~minutely) P&L updates.

The asset management we are designing the flow architecture for requires real-time P&L dashboards as well as monthly/quarterly reports. That’s why the PNL application is subscribing to real-time data from MarketData application via MarketDataUpdates event. It also needs to keep track of orders so it knows whether a position has been opened or closed which is why it subscribes to EMSOrder event that the EMS application is publishing.

The P&L updates are then published via PNLUpdates event and consumed by the Web Dashboard (PNL) application and Reporting application. The web dashboard displays the real-time P&L and the Reporting application generates monthly and quarterly reports.

Data Warehouse and Compliance

Compliance application is part of the regulatory oversight to make sure everything is being run according to general regulations by the governing authority. For example, many trading firms restrict their employees from trading a security within 30-days of their last activity. Some firms restrict their employees from futures or options trading but allow them to trade ETFs intraday. To enforce these rules, employees are expected to share their personal trading activity with the firm. To be able to compare a trader’s personal trading activity with the firm’s trading activity, the Compliance application needs access to both sets of data. The Compliance application can get the firm’s trading activity in real-time by subscribing to EMSOrder event.

Finally, companies usually have a data warehouse where they store all sorts of data for ad-hoc reporting, analysis, and/or record keeping. For this, the Data Warehouse application can subscribe to certain types of data and record it in a database. In our example, it is subscribing to EMSOrder event but it could have also been subscribing to OMSOrder event.

Risk

With so much money at stake, asset management firms typically have a Risk application responsible for monitoring risks in real-time at both micro and macro levels. For example, a firm would be interested in knowing how the global indicies are performing and if there is any that is experiencing unexpected movement. For example, the firm would want to know if The Bovespa Index (contains about top 70 Brazilian firms) is suddenly down 6%. Additionally, the firm might also want to assess risk at a micro level by keeping track of its positions and portfolios and ensuring it’s not heavily invested in a particular region, currency, or asset class.

To be able to perform risk analysis, the Risk application would be interested in StatsUpdates from TickData application and EMSOrder event from EMS application. It will use this data to monitor price movements and monitor order execution.

Conclusion

The flow architecture I showed above was just for the trading system at an asset management firm. There are more applications and a lot more events that flow throw applications deployed by such a firm. As more and more firms move from batch-oriented polling jobs to real-time event-driven architecture, it becomes important to document not only these events but the entire flow and their dependencies. Who is publishing an event and who are all the applications subscribing to this event? If I change the topic an application is publishing an event to, do I need to notify any downstream applications? These important questions become extremely easy to answer when you are using the right tool.